ESG Research: What measures are being taken by the company to reduce its carbon emissions? Also, provide Scope 1, Scope 2 and Scope 3, as reported by the company?

Regulatory alignment: Which companies are meeting SFDR’s Article 9 requirements?

Peer Comparison: Compare worker safety records and initiatives of Amazon, Walmart, and Target in the last year.

ESGSure delivers instant, factual analysis to support your ESG research, screening, exposure, due diligence, requirements. Our AI-powered platform enables financial institutions, corporates, consultants, and other stakeholders to automate their ESG research, ensuring SURE results in seconds.

KNOW HOW YOU CAN SCALEESGSure’s AI-driven platform adapts effortlessly to your research needs. From factor research and screening to due diligence and gap assessments, get the insights you need with precision and ease.

Explore all features and functionalities with no commitment.

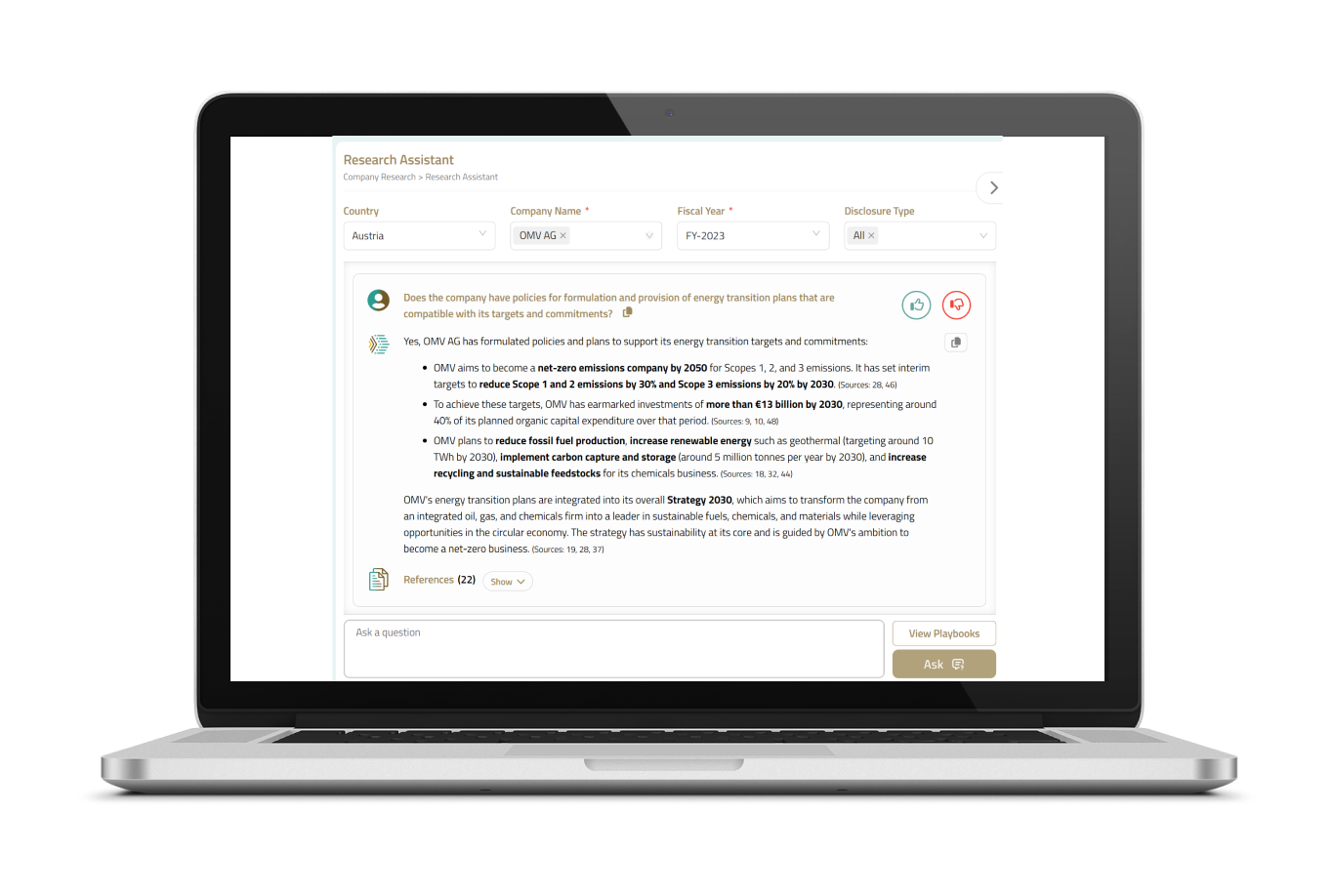

Choose a company or multiple companies from over 15000 global companies.

Enter your ESG question or select from ESG Playbooks curated to cover global frameworks, and receive comprehensive, up-to-date insights.

Review disclosures, download evidence. API integration is available to manage large volumes of research.

ESGSure, a product of ESGDS (https://www.esgds.io), is an AI-powered ESG research platform revolutionizing how organizations research ESG performance. Using a simple interface, users can access ESG performance data of more than 15,000 global companies.

ESGSure enables financial institutions, corporates, consultants, researchers, and NGOs to easily understand ESG risks and performance. ESGSure makes ESG intelligence accessible facilitating greater transparency.

Join us in shaping a future where ESG factors are integral to business and investment decisions. With ESGSure, comprehensive ESG analysis is at your fingertips.

Our experience working with global companies gives us deep insights into diverse industries and regional compliance requirements, enabling us to understand exactly what our users need for robust ESG research and decision-making. ESGSure empowers financial institutions, corporates, and investors to make informed, responsible decisions with confidence.

The platform already houses a knowledge base of more than 15000 listed corporates, REITS and high disclosure private enterprises. Our Off the shelf research questions enables evaluation of compliance with standard exclusionary screens and Global regulatory frameworks at the click of a button. Research output with agreed entity identifiers can be available either as flat files or Jsons for APIs exchange.

Our domain experts continuously train and update ESGSure's AI, incorporating the latest ESG standards, company disclosures, news and practices. This approach minimizes AI hallucinations and human bias, ensuring objective, up-to-date analysis.

All disclosures used for ESG research are analyst curated and regularly updated in the platform ensuring that reliable information on corporates are always available enabling rigorous research. Our prompt engineering ensures that the questions are provided in the right context and relevant disclosures are researched before an answer is provided.

Our AI models provide full provenance for every insights, ensuring you are confident of the research.

ESGSure leverages state-of-the-art natural language processing and machine learning technologies. Our AI models use advanced semantic understanding to analyze company disclosures. Through techniques like named entity recognition, sentiment analysis, and topic modelling, we extract relevant ESG information with high accuracy. Our models are continuously improved by our team of ESG experts, ensuring the highest standards of reliability and relevance.

Join us in shaping a more sustainable future through informed, data-driven ESG practices. With ESGSure, comprehensive ESG intelligence is just a click away.

EXPLORE OUR USE-CASES